By John Powers*

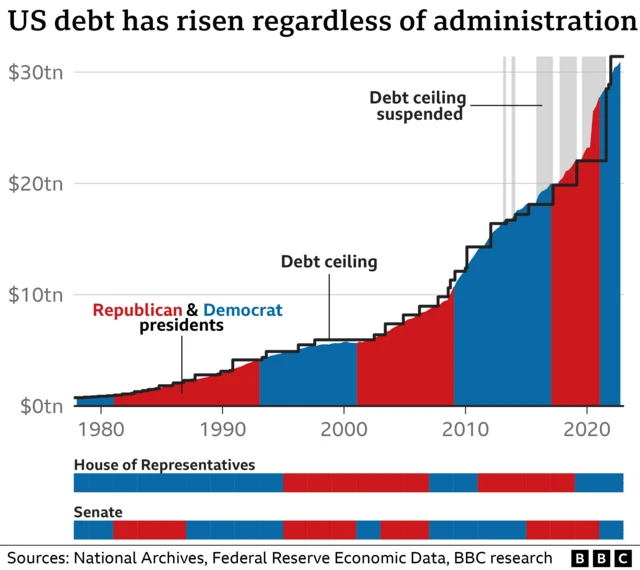

The most likely threat to long-term national security is not from the wars in Ukraine or Israel. It’s not from China’s provocative actions towards Taiwan, or its interference in freedom of navigation in the East and South China seas. Nor, is it from a mass drone, cyber, or ballistic missile attack.

No – the most likely threat to Australia’s national security, short of nuclear war, is from the US’s national debt.